Plan Administration and Service Center

42985 W Magic Moment Dr., Maricopa, AZ 85138-8534

Copyright 2024, Valley View Consultants, Inc. All Rights Reserved.

The World Equity Group Form CRS can be found here.

Valley View Consultants, Inc. (VVC)

VVC is the administrator of The STAR Plan (Strategic Talent Appreciation and Recognition).

The STAR Plan (2003-2023) allowed qualifying executives to personally own an institutionally-priced life insurance policy (ILI) as an alternative to taxable fund investing.

Why do banks, corporations and highly-compensated executives own ILI? Cost-savings.

___________________________________________________________________________________________________________

As a fund investor, what makes more sense?

- Losing an average of 25% to 35% of your lifetime gains to taxes?

- Losing an average of 5%-7% of your lifetime gains to ILI expenses, while receiving added financial protection at death?

___________________________________________________________________________________________________________

By 2023 all ILI issuers had retreated from the executive-owned and funded ILI space.

- Today executives only have access to less efficient products priced for retail life insurance distribution.

VVC’s role is servicing existing STAR participants across the country.

I

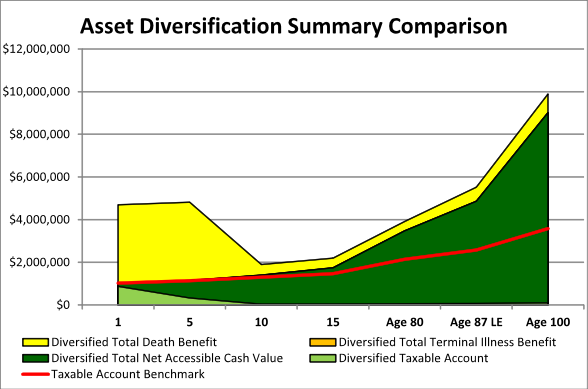

Age 50 ILI Qualifying Individual - $1 million in Taxable Brokerage Account - Taxable Benchmark (Red) vs ILI Asset Diversification.

89% increased Net Accessible Cash and 114% increased Death Benefits at Average Life Expectancy.

Comparable or greater lifelong Net Accessible Cash plus added Financial Protection.

_____________________________________________________________________________________________________

This site provides relevant information on specific estate, business and financial planning topics.

Information and hypothetical illustrations of mathematical principles are for informational and educational purposes only.

| C. M. Whitelaw |

| Disclaimer |

| Contact Us |